ZuluGuard™ Details

What is ZuluGuard™?

It’s simple – ZuluGuard™ is your safety net when trading in ZuluTrade!

It is there to protect your Equity by always monitoring your account, secure your profits and minimize any potential losses! *

Why would I need a safety net?

Although most Traders typically provide consistent and profitable strategies, sometimes even the best ones can get things wrong! If that happens, we want you to be able to secure your realized profits and minimize potential losses – and ZuluGuard™ can offer you just that.

ZuluGuard™ will automatically monitor your account and the performance of each Trader for you, every second, even when you’re not online! If ZuluGuard™ detects any significant changes in a Trader’s performance, it will step in and protect your account.

All you need to do is set your own risk allowance, the exact parameters of how much exposure you wish to allow in your account prior to ZuluGuard™ taking action!

How does ZuluGuard™ work?

ZuluGuard™ allows you to set the funds you wish to invest for each trader and will ensure that you will not risk more funds than the selected maximum amount per Trader.

For example, if you set the Funds to invest at €2500, it means that the maximum amount of your initial capital that you can lose by following this specific Trader is €2500. In the advanced follow mode, you will find more options allowing you to set more advanced settings to protect your profits and capital!

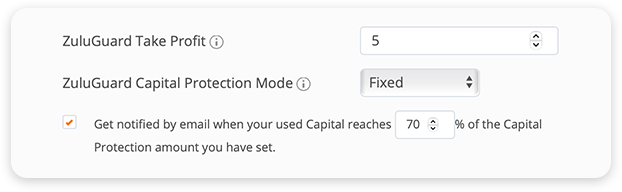

ZuluGuard Take Profit

Simply tell ZuluGuard the monetary amount you wish to secure! When this profit is reached, ZuluGuard™ will be triggered!

For example: You set ZuluGuard Capital Protection at $1500 and Take Profit at $800. If the Trader has a total PnL (total PnL = realized + floating) that reaches your Take Profit value, ZuluGuard will step in, close all trades and disable the Trader, securing your profit of $800. Note: You will be able to re-enable the Trader at any moment by re-setting ZuluGuard in your account.

ZuluGuard™ Capital Protection Mode

This option allows you to set a fixed or trailing capital loss stop. Fixed: If you set Capital Protection to $500, in case the Trader is losing $500 in your account, ZuluGuard™ will step in and close the trades of this Trader. Attention, in the fixed version, the Capital Protection is set as per the initial capital invested - not taking into consideration any future profits. If the Trader has closed trades that have a PnL of $2,000 in your account and his next trade has floating losses of -$500, the ZuluGuard™ will not step in. The ZuluGuard™ will only be activated at $-2500.

Trailing: If you set Capital Protection to $500, in case the Trader is losing $500 in your account, ZuluGuard™ will step in. However, this mode will move up exactly like a trailing stop for the whole strategy. If the Trader has closed trades that have a PnL of $2,000 in your account and his next trade has floating losses of -$500, then ZuluGuard™ will step in, and secure profits of $1,500!Capital Protection Notification

Get notified when your Used Capital (realized plus floating PnL) reaches a specified percentage of the Capital Protection amount you have set for this Trader.

Example: You set ZuluGuard Capital protection at $1500 and you set the notification option at 50%. If the used capital for your Trader reaches 50% (- $750) of the Capital Protection amount you have set ($1500), you will receive an email inviting you to monitor closely your account and ZuluGuard Settings for this Trader.

You can read more about capital protection here

So how exactly ZuluGuard™ protects my account?

Once ZuluGuard™ detects that your allowances have been exceeded, it takes action:

Close all Trader's trades

ZuluGuard™ closes all the currently open trades of the Trader in your account.

Disable the Trader

ZuluGuard™ disables the Trader so that he cannot open any new trades in your account.

Sounds useful! How do I set ZuluGuard™?

Setting up ZuluGuard™ is very easy!

You can enable and customize ZuluGuard™ from your Settings tab.

Simply click on the shield and review/amend your ZuluGuard™ settings for each of your Traders.

The gray ZuluGuard™ shield indicates you have not set any ZuluGuard™ protection for this Trader yet. The orange ZuluGuard™ shield indicates you are protected by ZuluGuard™!

* Important Disclaimer: In volatile, or fast moving market conditions, ZuluGuard closing signals will be filled at the prevailing market price, which may be vastly different from the desired price. Due to this, there may be substantial losses, as ZuluGuard does not always guarantee the desired Protection.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. Please check our full disclaimer.